Inflation has been one of the biggest economic concerns in recent years, but recent data suggests that inflation is cooling. This is good news for consumers and investors, as lower inflation typically leads to more stable interest rates and a stronger stock market. However, just as optimism grows, new tariffs announced by President Donald Trump could complicate the outlook. With both forces at play, what does this mean for the markets moving forward?

Inflation Is Slowing—What That Means for the Market

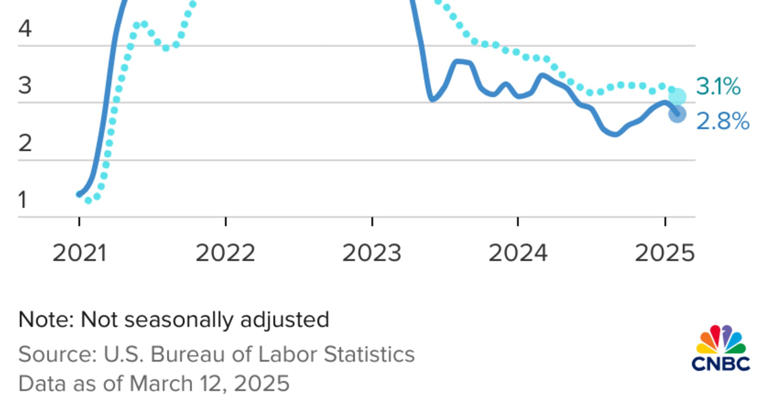

After a period of stubbornly high inflation, recent reports show that price increases are slowing. The Federal Reserve’s aggressive rate hikes over the past two years appear to be working, with inflation gradually moving closer to the Fed’s 2% target. As a result, investors have been more optimistic that:

- The Federal Reserve may pause or even cut interest rates sooner than expected.

- Lower borrowing costs could boost corporate earnings and increase market confidence.

- Consumers may feel more financial stability, leading to increased spending and investment.

Historically, when inflation eases, the stock market tends to rally. Lower interest rates allow businesses to borrow and invest more easily, which can fuel growth in the economy and push stock prices higher.

Could New Tariffs Reverse Market Gains?

Just as the economy appears to be stabilizing, the introduction of new tariffs could add uncertainty to the outlook. President Trump has announced:

- Higher tariffs on Chinese imports, increasing from 10% to 20%.

- New tariffs on steel and aluminum set to take effect in March.

- Potential 250% tariffs on Canadian dairy and increased tariffs on lumber.

Tariffs can have a mixed impact on the stock market. On one hand, they are designed to protect domestic industries from foreign competition. On the other hand, they increase costs for businesses that rely on imported goods, which can lead to:

- Higher production costs for companies that rely on materials like steel, aluminum, and lumber.

- Potentially higher prices for consumers if companies pass those costs along.

- Uncertainty for investors who may worry about trade wars disrupting economic stability.

How Will the Stock Market React?

Right now, the market is caught between two opposing forces: cooling inflation, which is positive for stocks, and new tariffs, which could introduce volatility. If inflation continues to ease, markets may remain resilient. However, if tariffs spark trade conflicts or increase costs for businesses, they could weigh down stock prices.

Key factors investors will be watching include:

- Future inflation reports to confirm whether price stability continues.

- The Federal Reserve’s response—will they cut rates or stay cautious?

- The impact of tariffs on corporate earnings and trade relationships.

What Does This Mean for Austin Homebuyers?

Economic shifts can impact more than just the stock market—they also influence mortgage rates and home prices. If inflation continues to cool, we could see mortgage rates decline, making homeownership in Austin, Texas more affordable. However, trade uncertainty and rising costs of building materials due to tariffs could lead to higher home prices in the future.

If you’re thinking about buying or selling in Austin, staying ahead of these trends is essential. That’s why working with the best realtor in Austin is the smartest move you can make.

Get Expert Real Estate Advice in Austin

Whether you’re looking to buy, sell, or invest, Brendan Sanford is here to guide you through the changing market.

📱 Call or text Brendan Sanford at (512) 696-0673

📧 Email: [email protected]

Let’s discuss how today’s economic changes could affect your real estate goals and create a strategy that works for you.