Before you fall in love with a new home in Austin, Texas, make sure you're not missing one critical step—checking whether it’s in a flood zone. While Austin isn’t the first city that comes to mind when you think of flood-prone areas, certain neighborhoods experience significant flash flooding during heavy storms. If you don’t check first, you could end up with extra insurance costs, higher risk of property damage, or future resale concerns.

Why Flood Zones Matter in Austin

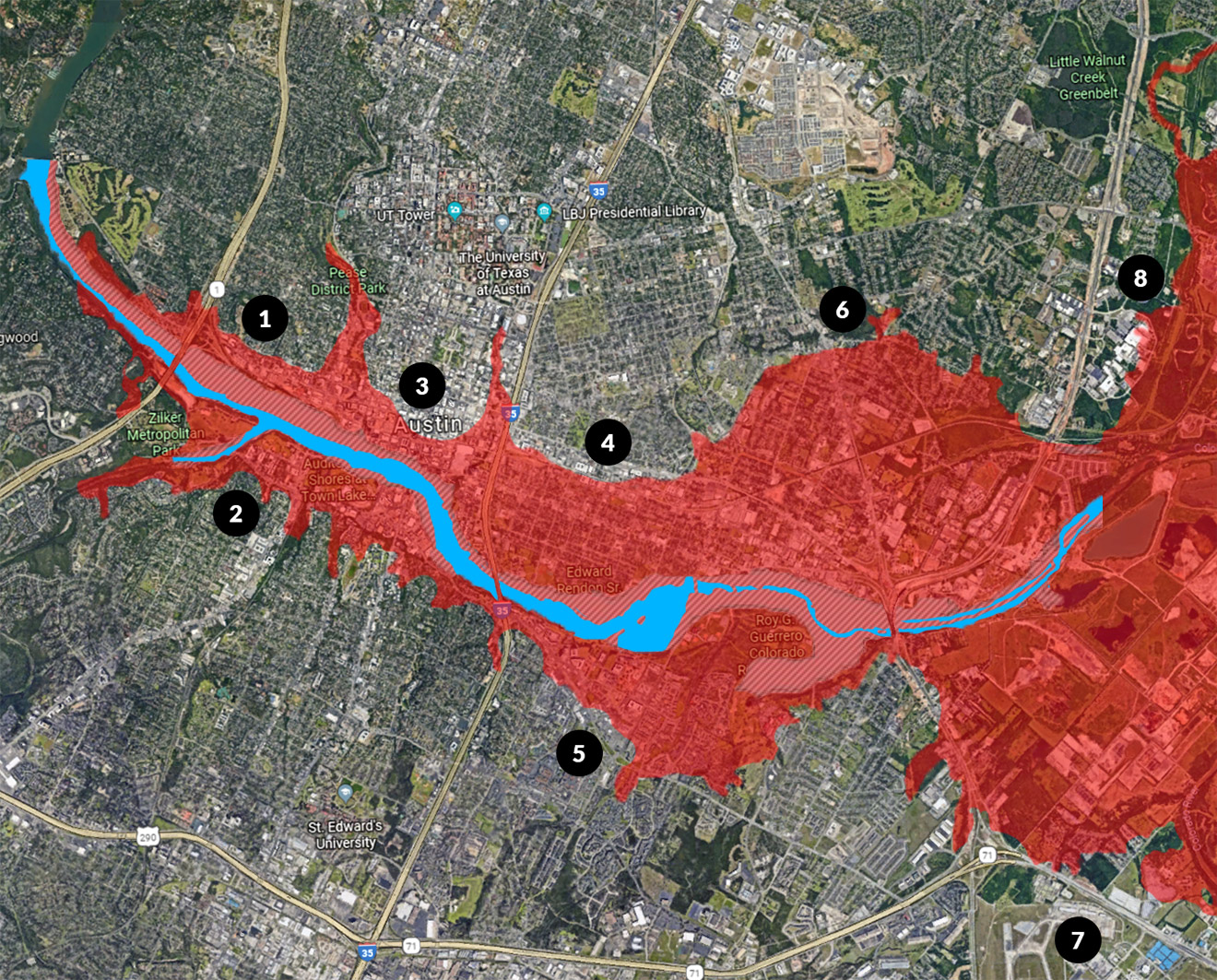

Austin is known for its rolling hills, creeks, and unpredictable storms. That combo can lead to sudden flooding—especially in low-lying areas like Onion Creek, Shoal Creek, and parts of South Austin. While the city has made major infrastructure improvements, floodplain risks still exist, and FEMA flood maps designate many areas as high or moderate risk.

Buying in a flood zone doesn’t automatically mean you shouldn’t proceed—it just means you need to be fully informed and financially prepared. In some cases, flood insurance may be required, and in others, it might simply be a smart precaution.

How to Check Flood Zones in Austin

Here’s how you can check if a property is in a flood zone before you sign that contract:

- Use FEMA’s Flood Map Tool: Visit https://msc.fema.gov and enter the property’s address to see if it’s in a designated floodplain.

- Check the City of Austin's Floodplain Maps: The city offers detailed flood risk data. Explore that here: Austin Floodplain Maps.

- Talk to Your Realtor: A knowledgeable local expert can provide insight into past flood activity, insurance needs, and how specific neighborhoods manage stormwater.

- Ask the Seller Directly: In Texas, sellers are required to disclose whether the home has flooded before or is located in a flood zone.

What If the Home Is in a Flood Zone?

If your dream home falls within a FEMA-designated floodplain, you’ll need to factor in the following:

- Flood Insurance: If you're financing through a lender and the home is in a high-risk zone, insurance is required. Costs vary based on location, elevation, and risk level.

- Elevation Certificates: These are sometimes needed to determine your flood risk more precisely and may help reduce insurance premiums.

- Mitigation Options: Raised foundations, flood vents, and sump pumps can all help protect the home and reduce insurance costs.

Low-Risk Doesn’t Mean No Risk

Roughly 25% of flood insurance claims come from homes outside of high-risk zones. Even if a property isn’t in a FEMA floodplain, Austin’s hilly terrain and heavy rain can cause localized flooding, especially in older neighborhoods with limited drainage systems.

Best Practices for Homebuyers

- Include a flood zone check as part of your home inspection or due diligence.

- Work with an experienced realtor in Austin who understands where flood risk is concentrated.

- Plan ahead for potential insurance needs or drainage improvements if buying in a flood-prone zone.

Final Thoughts

Buying a home in Austin is a big investment. Don’t skip this step. Knowing whether a home is in a flood zone protects you financially and helps you plan smarter for the long run.

If you’re ready to house hunt—or just want to double-check the flood risk in a neighborhood you're considering—reach out to the best realtor in Austin, Brendan Sanford. He’ll help you navigate flood zones, insurance needs, and property risks with confidence.

📱 Call or text: (512) 696-0673

📧 Email: [email protected]

Peace of mind starts with knowing what’s beneath your feet—and what could rise up around it. Let’s find you a safe, smart home in Austin.