Introduction

Embarking on the journey to homeownership is both exciting and daunting. While finding the perfect home is a dream for many, the financial intricacies involved can often be complex. Central to this process is the concept of a credit score. This three-digit number not only reflects your financial responsibility but also plays a pivotal role in determining the ease and terms of your home purchase.

Understanding Credit Scores

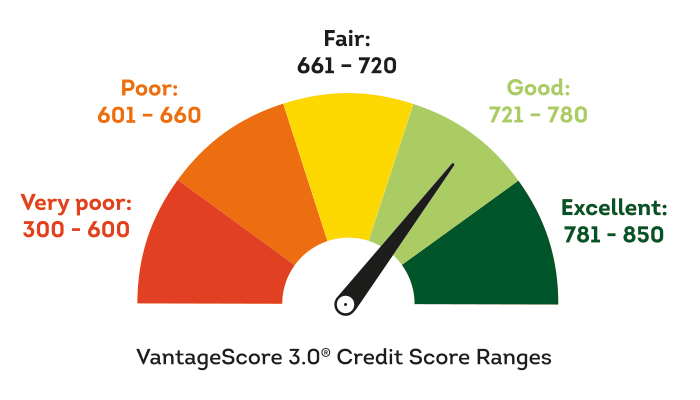

A credit score, at its core, is a numerical representation of an individual’s creditworthiness. It’s derived from an analysis of their credit history, serving as a snapshot for lenders to gauge the risk of lending money or extending credit to that individual. Several factors influence this score:

- Payment History (35%): This is a record of your payments on credit cards, loans, and other debts. Timely payments boost your score, while late payments, defaults, and bankruptcies can significantly lower it.

- Credit Utilization (30%): This refers to the ratio of your current credit card balances to your credit limits. A lower utilization rate is seen favorably, indicating you haven’t overextended your credit.

- Length of Credit History (15%): Lenders prefer individuals with a longer history of timely credit payments. This factor considers the age of your oldest credit account, the age of your newest credit account, and an average age of all your accounts.

- Types of Credit (10%): A mix of credit types, such as credit cards, retail accounts, installment loans, and mortgages, can be beneficial.

- Recent Credit Inquiries (10%): Opening several new credit accounts in a short period can be risky, especially if you don’t have a long credit history.

Why Credit Scores Matter in Home Buying

Your credit score is the gateway to your dream home. Here’s why it holds such weight in the home buying process:

- Influence on Mortgage Approval: A good credit score enhances your credibility. Lenders are more inclined to approve mortgage applications from individuals with higher scores, as it indicates a history of financial responsibility and a lower risk of default.

- Impact on Interest Rates: The interest rate on your mortgage is directly influenced by your credit score. Those with higher scores are often rewarded with lower interest rates, translating to significant savings over the life of the loan.

- Loan Terms and Conditions: A favorable credit score can also impact the terms of your loan. Lenders might offer larger loan amounts or more flexible repayment terms to those with robust credit histories.

Navigating the home buying process requires a keen understanding of the financial landscape. Your credit score, a key player in this journey, can be the difference between favorable loan terms and missed opportunities. By recognizing its importance and taking steps to improve it, you pave the way for a smoother, more beneficial home buying experience.

The Financial Implications

The ripple effect of a good credit score extends far beyond just loan approval and interest rates. Let’s delve into the broader financial implications:

- Long-term Savings: A difference of even 1% in your mortgage interest rate, stemming from a good credit score, can translate to thousands of dollars saved over the life of a 30-year loan. This means more money in your pocket in the long run.

- Down Payment Requirements: Lenders often have tiered requirements for down payments based on credit scores. A higher score might mean you’re required to put down a smaller percentage of the home’s purchase price, easing the initial financial burden.

- Private Mortgage Insurance (PMI): If you’re unable to make a 20% down payment, you might be required to pay PMI. However, with a higher credit score, you might qualify for a reduced PMI rate or even bypass it altogether, depending on the lender’s policies.

Improving Your Credit Score Before Buying

If you’re gearing up for a home purchase, it’s never too early to start bolstering your credit score. Here are some actionable tips:

- Pay Bills on Time: Consistency is key. Ensure all bills, especially debts, are paid promptly. Setting up automatic payments can be a helpful tool.

- Reduce Outstanding Debt: Aim to lower your credit utilization by paying down credit card balances and avoiding accumulating more debt.

- Avoid New Credit Inquiries: Each time you apply for a new line of credit, it can slightly ding your score. If you’re close to buying a home, it’s best to avoid opening new accounts.

- Check for Errors: Obtain a free credit report and scrutinize it for any discrepancies or errors. Rectifying these can give your score a quick boost.

Overcoming Challenges with a Lower Credit Score

A less-than-stellar credit score isn’t the end of your homeownership dreams. There are paths forward:

- Alternative Financing Options: Consider loans like FHA or VA loans that are designed for individuals with lower credit scores.

- Seek a Co-signer: A co-signer with a better credit score can bolster your mortgage application, making approval more likely.

- Shop Around: Don’t settle for the first mortgage offer. Different lenders have different criteria, and some might offer more favorable terms despite a lower credit score.

Conclusion

The journey to homeownership is a mosaic of various financial and personal decisions, with your credit score serving as a cornerstone. While a good score can open doors to favorable loan terms and interest rates, a lower score isn’t a dead end. With diligence, informed choices, and a proactive approach, your dream home is well within reach. Whether you’re just starting out or are deep into the home buying process, understanding and optimizing your credit score is a step you won’t regret.